No need for haste in raising interest rates

Low interest rates have been the norm for banks when faced with economic recessions, but global recovery has been slow. Is now the time to seek an alternative route to boosting our global economic situation?

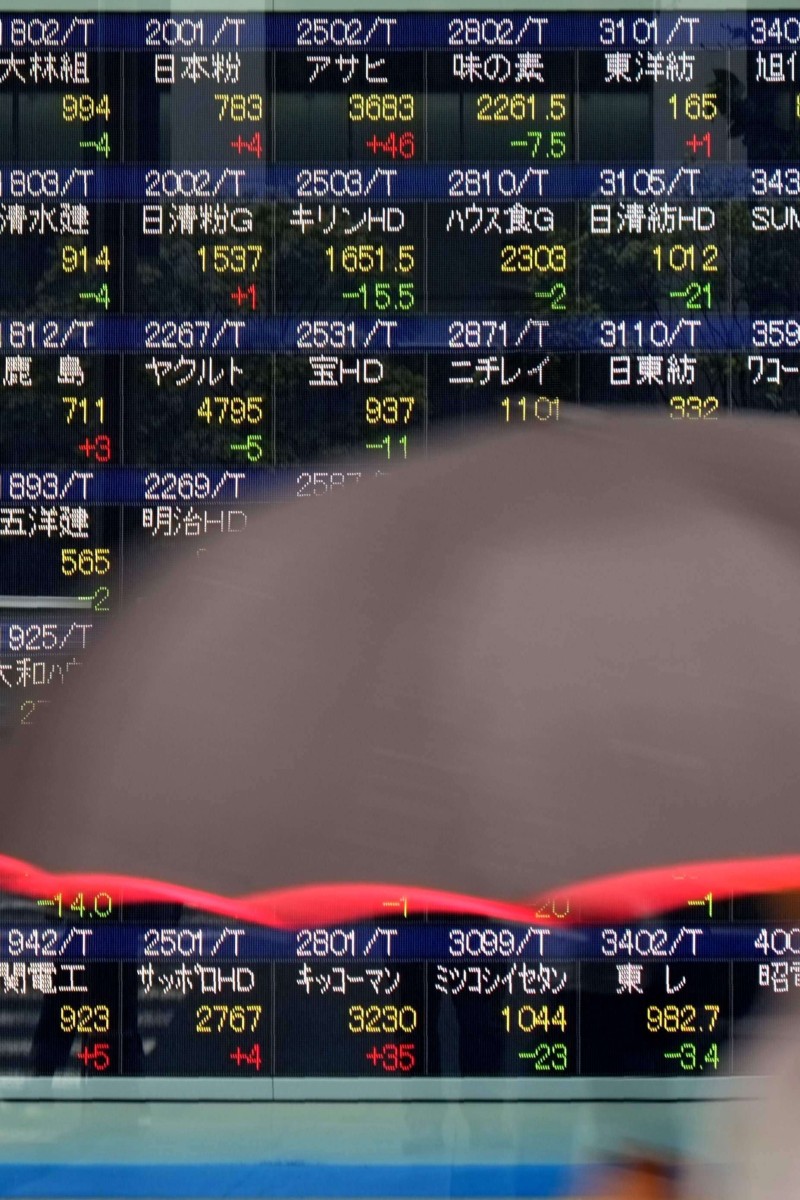

Interest rates can have a significant effect on stock markets around the world.

Interest rates can have a significant effect on stock markets around the world. Of the many stress-inducing questions facing investors and economists these days, one looms particularly large: when are central banks going to raise interest rates?

Attempting to predict anything related to the economy is a rather perilous task – the late Nobel laureate Paul Samuelson once quipped that “markets have predicted nine out of the last five recessions.” Prediction has been a particularly hapless endeavour with post-crisis interest rates. Pundits forecasting an inevitable rates increase have seen themselves embarrassed repeatedly.

So why are interest rates near zero per cent anyway? In response to the global economic crisis, central banks around the world, particularly in developed countries, slashed interest rates to record low levels. Cutting interest rates is the standard response to an economic contraction. For maximum effect, these interest rate cuts were combined with a series of monetary policies collectively known as quantitative easing.

The primary intended effect of low interest rates is low borrowing costs. When borrowing money becomes cheaper, businesses find it easier to ensure that the return on their investment exceeds the cost of their loan – simply put, investing into the economy becomes more profitable. This creates employment, which also helps boost the level of spending in the economy and ultimately makes everyone better off.

As spending increases, so does inflation, which in turn encourages more spending. (The expectation of an increase in inflation encourages present spending on the fear that purchasing power will decrease in the future.) Or so it goes in theory.

Reality has been less generous to policymakers. The recovery from the crisis has been rather lacklustre. Although unemployment is down – the American economy, for example, is operating at near “full employment” levels of 4-5% unemployment – economic growth in most countries remains tepid. Some of the drop in unemployment has also been attributed to working age people simply leaving the work force and ceasing to look for jobs. These people are technically not “unemployed,” but a decrease in labour force participation rates augurs badly for economies.

Inflation remained stubbornly low, and instead of investing into the economy, corporations have been sitting on growing piles of cash – essentially an indicator that the perceived rewards from investments do not outweigh the risks.

With this backdrop, many observers have begun to criticise the current state of monetary policy. With the Federal Reserve once again voting to keep rates near zero, and inflation-adjusted interest rates slipping into negative territory in some countries, some argue that the low-interest regime should be discontinued.

There are valid arguments to be made that artificially deflated interest rates may even be exacerbating problems plaguing the economy. Meagre returns on savings mean that future retirees have to sock away more today to meet savings goals. Similar logic applies to companies with pension obligations to meet in the future. The natural consequence of this is less current spending in the economy and depressed growth. The side effects from low interest rates certainly may be potent, but it is unlikely that they overwhelm the substantial incentive to spend engendered by the ability to borrow money nearly for free.

The global economic situation remains precarious. Inflation remains sluggish, growth is poor, and spending has yet to pick up to the desired levels. A rise in interest rates, however, could jeopardise whatever progress has been made. In combination with that, the sudden shock to markets grown used to a low interest rate environment could help push the global economy back into a recession, resulting in joblessness and reduced future prosperity.

Instead, more fiscal measures may help bolster the economic recovery. Fiscal policy, which entails government measures like spending programmes and tax cuts, can be unpopular due to their tendency to increase budget deficits. In a time like this, however, with borrowing costs for some rich world governments below zero – yes, that does indeed mean the government can borrow your money and have you pay them for the privilege! – there could be no better time to lock in cheap long-term funding.

There can be little denying that monetary policy has been less effective than was hoped for, and that conventional economic theory would have predicted stronger results. This is no reason to embark unknowingly into uncharted territory – and in doing so, gamble with the fortunes of the global economy.